3 actions immobilières très rentables (dont la préférée de Warren Buffett) - Plus-Riche : Mieux Investir

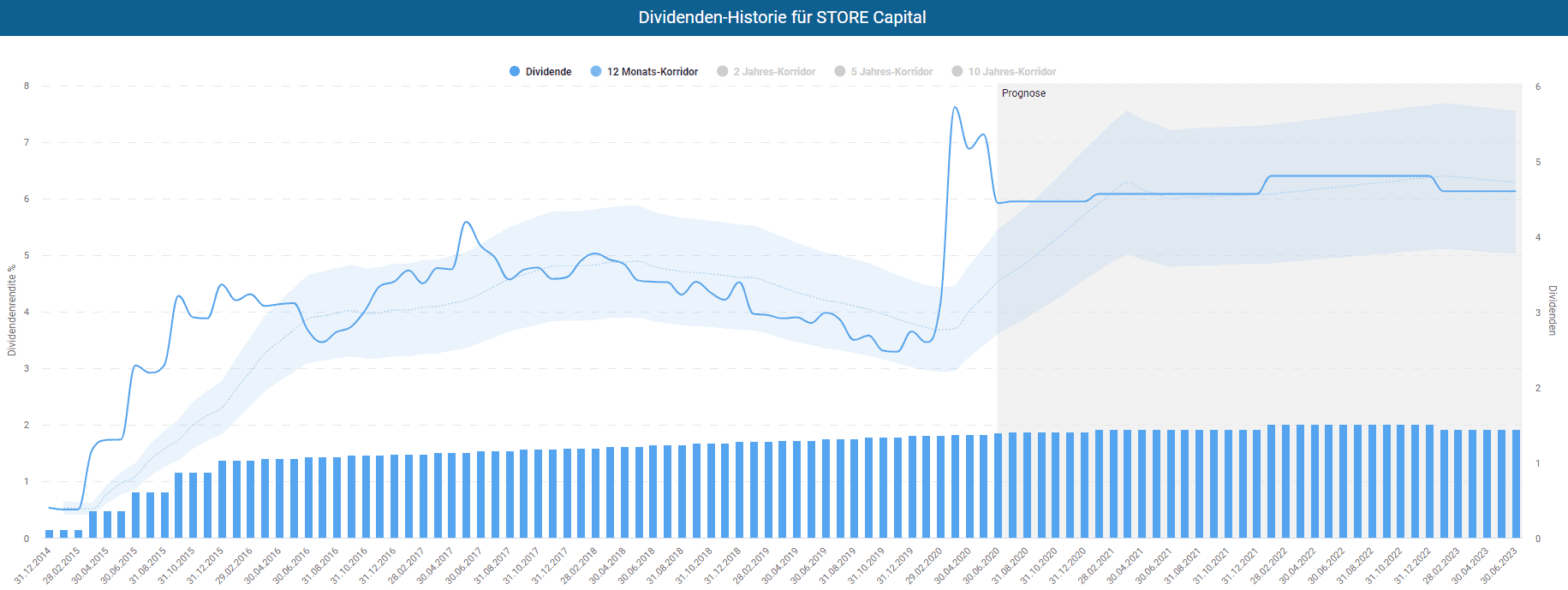

STORE Capital Corporation kondigt dividend over het derde kwartaal van 2022 aan, betaalbaar op 17 oktober 2022 -19 september 2022 om 14:31 uur | MarketScreener

STORE Capital (STOR) announces dividend increase of 6.5% to $0.41 quarterly per share on September 19, 2022. Dividendhike.com | Dividend News and Statistics for US Equities

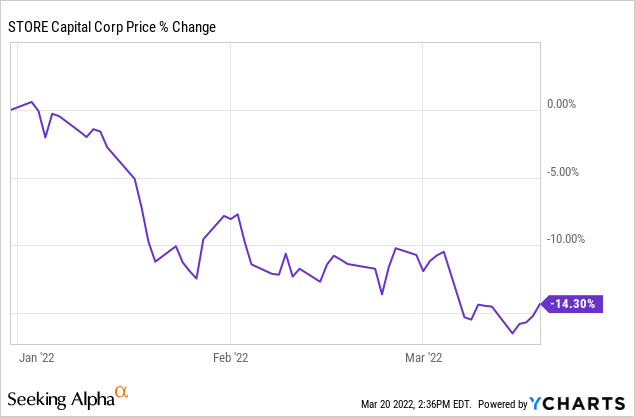

Store Capital: A Blue-Chip REIT, But It's 15% Overvalued | Seeking Alpha | Reit, Capitals, Payment schedule

![I was COMPLETELY wrong about STORE Capital (STOR), Now I am BUYING [Dividend Investing] - YouTube I was COMPLETELY wrong about STORE Capital (STOR), Now I am BUYING [Dividend Investing] - YouTube](https://i.ytimg.com/vi/8hJHmHsWnKE/maxresdefault.jpg)